Coal has long been a fundamental energy source, powering industries, electricity generation, and manufacturing processes around the globe. Despite the growing shift towards renewable energy and clean alternatives, coal remains a crucial element in the global energy mix, especially in emerging economies where energy demand continues to rise. However, coal prices are subject to a wide array of variables, ranging from supply-demand imbalances and geopolitical tensions to environmental regulations and technological advancements.

This article will explore the factors driving coal price trend, historical price fluctuations, and future forecasts. By understanding the dynamics that influence coal pricing, stakeholders in the energy and industrial sectors can better anticipate market movements and make informed decisions regarding procurement and investments.

1. Understanding Coal and its Market

Coal is a combustible black or brownish-black sedimentary rock composed mainly of carbon, along with various other elements, including sulfur, hydrogen, oxygen, and nitrogen. It is primarily used as a fuel source in electricity generation, industrial processes, and heating.

There are four main types of coal, each with varying energy contents and uses:

- Anthracite: The hardest and highest-grade coal, used primarily for domestic heating and certain industrial processes.

- Bituminous: The most commonly used coal, especially in power plants and steel production.

- Sub-bituminous: A lower-grade coal with a moderate carbon content, often used in power plants.

- Lignite: The lowest grade of coal, used mainly for electricity generation in regions where it is abundant.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/coal-price-trends/pricerequest

The coal market is influenced by the following key factors:

- Global demand: Mainly driven by industrial growth, particularly in steel production, cement manufacturing, and power generation.

- Coal-producing countries: Major coal exporters like China, India, the United States, Australia, and Indonesia significantly impact global coal prices.

- Energy policies: Regulations governing the use of coal for energy production, especially concerning carbon emissions, can directly influence its market value.

- Environmental concerns: Increasing emphasis on reducing greenhouse gas emissions and transitioning to cleaner energy sources influences the coal market.

- Geopolitical factors: Trade wars, export restrictions, and natural disasters can disrupt coal supply chains, affecting pricing.

2. Key Drivers of Coal Price Trends

2.1 Supply and Demand Dynamics

As with any commodity, coal prices are primarily influenced by supply and demand factors. Coal consumption is driven by electricity generation, steel production, and industrial applications, with the largest consumers being China, India, the United States, and European countries.

- Global Energy Demand: In developing economies, rising demand for energy—driven by industrialisation and urbanisation—directly affects coal consumption. For instance, in countries like India and China, coal remains the dominant fuel for power generation, leading to a steady demand for the commodity. Conversely, in developed nations, coal usage has been declining in favour of cleaner energy sources like natural gas, renewables, and nuclear.

- Coal Supply Disruptions: The supply side of the coal market is susceptible to disruptions due to factors such as mine closures, natural disasters, and logistical issues. For example, strikes or transportation bottlenecks can lead to supply shortages, pushing coal prices higher.

- Export and Import Trends: Major coal exporters like Australia, the U.S., and Indonesia influence global prices through their export policies. Trade restrictions or tariffs, particularly between coal-producing countries and large consumers, can lead to price volatility. For example, trade tensions between China and Australia have caused shifts in the coal market, as China has reduced imports from Australia and sought coal from other sources like Indonesia and Russia.

2.2 Energy Transition and Environmental Regulations

The global shift towards cleaner energy is one of the most significant factors affecting the coal market. As nations strive to meet international climate agreements, such as the Paris Agreement, coal consumption is under scrutiny due to its carbon intensity.

- Carbon Emissions and Pollution Control: Many countries are setting ambitious decarbonisation goals, which include reducing coal’s share in the energy mix. The imposition of carbon taxes, carbon credit systems, and stricter environmental regulations is increasing the cost of coal-based electricity generation, making it less attractive for investors and utilities. For instance, European countries and the United States have seen a decline in coal demand as they shift to natural gas and renewables.

- Renewable Energy Growth: As the cost of renewable energy sources like solar, wind, and hydropower continues to decrease, many countries are phasing out coal-fired power plants in favour of cleaner alternatives. This shift is expected to reduce demand for coal in developed regions, exerting downward pressure on prices.

2.3 Geopolitical Factors

Geopolitical events play a vital role in coal price movements. Trade policies, tariffs, and export restrictions between major coal-producing countries and key consumers can impact coal availability and prices globally.

- China’s Role: As the world’s largest coal importer, China’s coal policy decisions significantly influence global prices. For example, China’s decision to halt coal imports from Australia in 2020 led to a shift in trade flows and price volatility. Similarly, fluctuations in Chinese domestic production or changes in import tariffs can create ripple effects across the global coal market.

- Energy Security: Geopolitical instability in coal-rich regions, such as Eastern Europe, Russia, and the Middle East, can disrupt global supply chains. Conflicts, sanctions, or trade disruptions in these regions could result in tighter coal supplies and higher prices globally.

2.4 Natural Disasters and Weather Patterns

Coal production and transport can be severely impacted by natural disasters such as floods, hurricanes, and droughts. For example, in 2020, floods in Queensland, Australia, disrupted coal mining operations, leading to a temporary increase in prices.

- Transportation Issues: Coal is typically transported via rail or sea, and any disruptions to these transport systems, whether due to weather conditions or infrastructure failures, can delay shipments and drive up prices.

- Seasonal Demand: Coal prices also exhibit seasonal fluctuations, as demand for heating coal increases during colder months. In regions that rely on coal for winter heating, prices tend to rise as demand peaks.

2.5 Technological Advancements and Efficiency Improvements

Technological advancements in coal mining and energy production can influence the coal price trend. Innovations that improve mining efficiency or reduce the environmental impact of coal consumption may help lower costs and extend the viability of coal in the global energy market.

- Clean Coal Technologies: Technologies like carbon capture and storage (CCS) could enable coal to be used more sustainably, potentially mitigating some of the negative environmental impacts associated with its use. If such technologies are adopted at scale, they could reduce the pressure on coal prices driven by environmental regulations.

- Energy Efficiency: Improvements in power plant efficiency and the use of high-efficiency, low-emissions (HELE) coal-fired plants can make coal a more competitive energy source, potentially stabilising or even increasing its demand in certain regions.

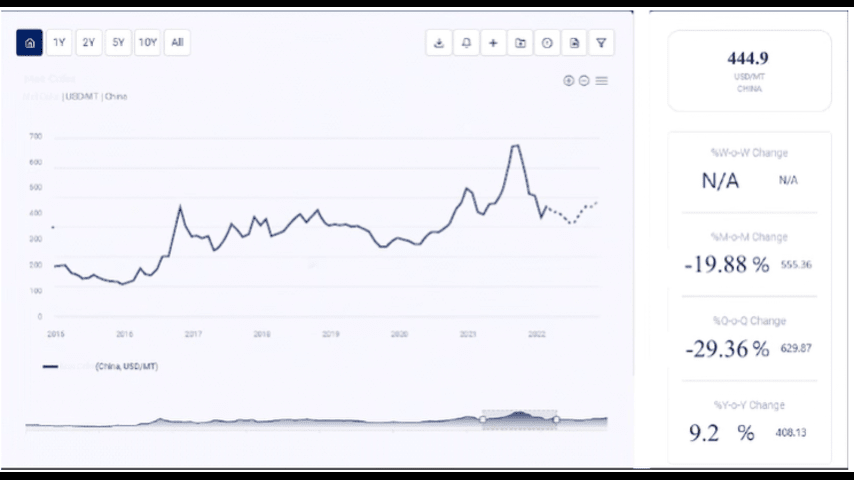

3. Historical Coal Price Trends

To understand the current coal price environment, it is important to examine historical trends. Coal prices have experienced significant fluctuations over the past few decades.

- 2000-2008: During this period, coal prices were relatively stable, with gradual increases driven by rising global demand, particularly in Asia. The rapid industrialisation of China and India led to higher coal consumption, and prices began to rise.

- 2008-2014: The global financial crisis in 2008 led to a temporary slump in coal prices, but by 2009, the market began recovering due to sustained demand from China. In 2011, coal prices hit their peak, driven by robust demand from both developed and developing countries.

- 2015-2020: The period following 2014 saw a significant decline in coal prices due to factors such as slower global economic growth, a shift towards renewable energy, and stricter environmental regulations. This period marked the start of coal’s decline in Western markets, particularly in Europe and the U.S.

- 2020-Present: The COVID-19 pandemic and resulting economic disruptions caused a temporary drop in demand for coal, but prices have been recovering due to supply chain disruptions, especially in key producer countries like Australia and Indonesia. Furthermore, rising energy prices and increased demand from countries like China and India have contributed to price surges in 2021 and 2022.

4. Forecasting the Future of Coal Prices

Looking ahead, coal prices are expected to experience continued volatility, influenced by several key factors:

- Global Energy Transition: While renewable energy continues to gain traction, coal will likely remain an essential energy source in many emerging economies for the foreseeable future, particularly in Asia. However, increasing environmental regulations and the global shift towards cleaner alternatives will continue to exert downward pressure on coal prices in developed markets.

- Geopolitical Risks: Political tensions between major coal-producing countries and consumer nations, along with the ongoing energy crisis, will likely continue to influence global coal prices.

- Technological Advancements: If technologies like carbon capture and storage (CCS) become more widely adopted, it could support the demand for cleaner coal, potentially stabilising prices in the long run.

- Energy Supply and Demand: Given the continued reliance on coal for electricity generation in many regions, global coal prices are likely to remain relatively high in the short term. However, longer-term price trends will depend on the pace of the energy transition and the level of investment in renewables.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA & Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA